Tags :

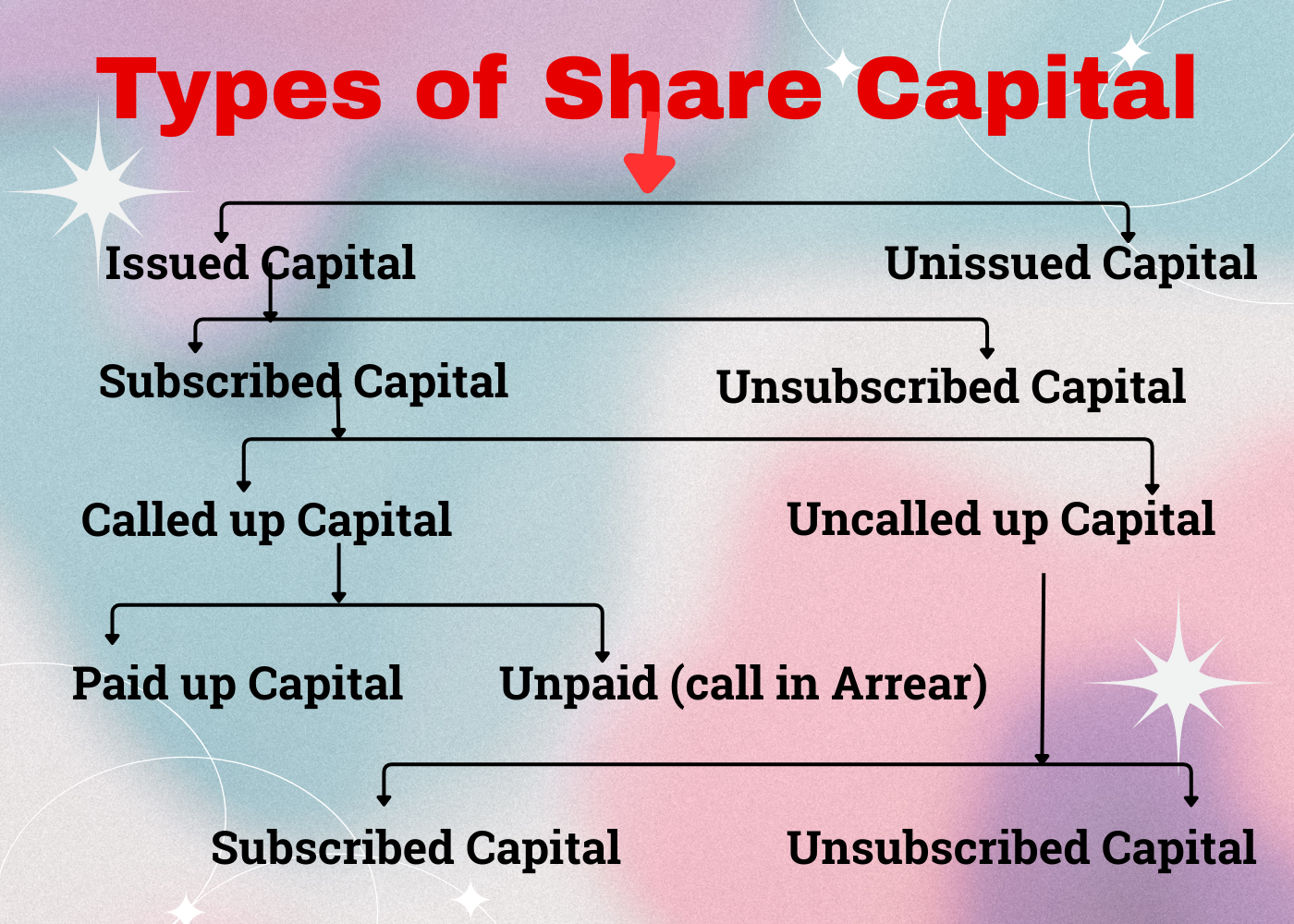

Accounting for companies, Authorised and Issued Capital, Called-up and Uncalled Capital, CBSE, Class 12 Accountancy notes, company accounts revision, Easy tips, ICSE, NIOS, paid up vs called up capital, Reserve Capital in Company Accounts, share capital, Shareholder’s Equity, Subscribed vs Paid-up Capital, Types of share capital flowchart